On the surface, it can be easy to oversimplify our motivations at work, and the factors which keep us happy in our jobs. Do we overlook the things which really matter to us as we pursue other, more obvious career goals?

With the rise of ‘quiet quitting’ and 60% of the workforce in the market for a new job, as well as the cost of living crisis piling pressure on the shoulders of working Brits, it is critical now that the needs of employees are understood, and met, by management.

In this latest report from Medicash, we explore two communities to see how employed Brits and HR professionals benchmark the satisfaction of their working lives.

Both groups are inextricably linked. The positive efforts of HR professionals are felt by employees, just as the dissatisfaction of the workforce should (yet often doesn’t) influence the priorities of HR departments across the country.

As will be covered in this report, compassion truly counts, wellbeing truly matters, and organisations unable to demonstrate that to their employees may risk an exodus to companies that do.

Introduction

For this study, we wanted to compare and contrast the views of HR professionals and the employees that they are tasked with supporting to see where those views are aligned and what gaps need to be addressed going forward.

The first group consisted of 2,000 UK-based employees who work in a company with 10 or more people in the workforce. These people represent all walks of life and were located right across the UK.

The second consisted of 500 HR professionals – specialists with knowledge in the field of health and wellbeing at work, as well as the factors which keep employees happy in their roles.

Where will these two groups see eye-to-eye, revealing universal truths about the workplace, and where will their views differ?

Let’s find out…

Corporate Healthcare

Access to Corporate Healthcare

Turning our gaze to the 2,000 UK employees surveyed, we found that one in five place healthcare at the top of their workplace benefits priorities, and that good health and wellbeing is important to them when selecting a new place to work.

What is notable are the other benefits prioritised by employees, which include ‘Flexible working hours’ (42%), ‘Five weeks minimum annual leave’ (34%) and ‘The ability to work from where they want’ (25%). These are each indicative of a workforce which cares about wellbeing and striking a good work-life balance.

Top 5 benefits employees want their employer to offer

42%

Flexible working hours

34%

Five weeks minimum annual leave

25%

The ability to work where they want

22%

The opportunity for progression

20%

A health plan or other wellbeing benefits

42% of employees surveyed have their healthcare benefits either paid for or subsidised by their place of work, whilst 27% aren’t offered anything at all by their current employer.

And this omission hasn’t gone unnoticed. 49% of employees surveyed think it is the employer’s responsibility to look after the health and wellbeing of their employees, whether at home or in the workplace, with 43% saying that this should be paid for in full by the company.

With an ageing workforce, it is unsurprising to see that healthcare is at the forefront of older workers’ minds, with those aged 45 to 54 the most likely to see the value in work-subsidised health benefits. On top of this, four in five (83%) agreed that they have placed more value on healthcare benefits the older they have got.

The view from HR

Of the 500 HR professionals surveyed, 54% said their organisation offered company-paid healthcare benefits, with a further 21% offering access to subsidised benefits. This, however, contrasts significantly with the results we found from our survey of 2,000 employees.

HR professionals

Company offers healthcare benefits.

Employees

Get offered healthcare benefits via work.

Mental Health

HR professionals generally expressed concern about the limited efforts that their companies are making to support their employees with issues relating to their mental and physical health, especially as external pressures from global events mount.

36% think not enough is being done in their workplace to raise awareness about the importance of good mental health, whilst a shocking 82% observed an increase over the pandemic years in employees taking time off over mental health issues.

Over the past two years, what change have you seen in people taking time off work for mental health issues, including stress?

This also aligns with the view of workers, where 40% say their employer is not doing enough to support mental health in their workplace, whilst only 35% think their workplace has put appropriate measures in place to tackle this growing issue.

The Cost of Living Crisis

The UK has entered a cost of living crisis, and in an environment of rising energy bills, it’s unsurprising that a resounding 91% of our HR professionals expressed worry about the impact that the current cost of living crisis will have on staff wellbeing, with 41% saying that they were very worried about this.

Many organisations have stepped up to help reduce the impact that this will have on their workforce. These efforts have not gone unnoticed, and it is interesting to see the correlation between the measures HR professionals have taken to limit this impact, and the things employees have noticed in their workplace in recent months.

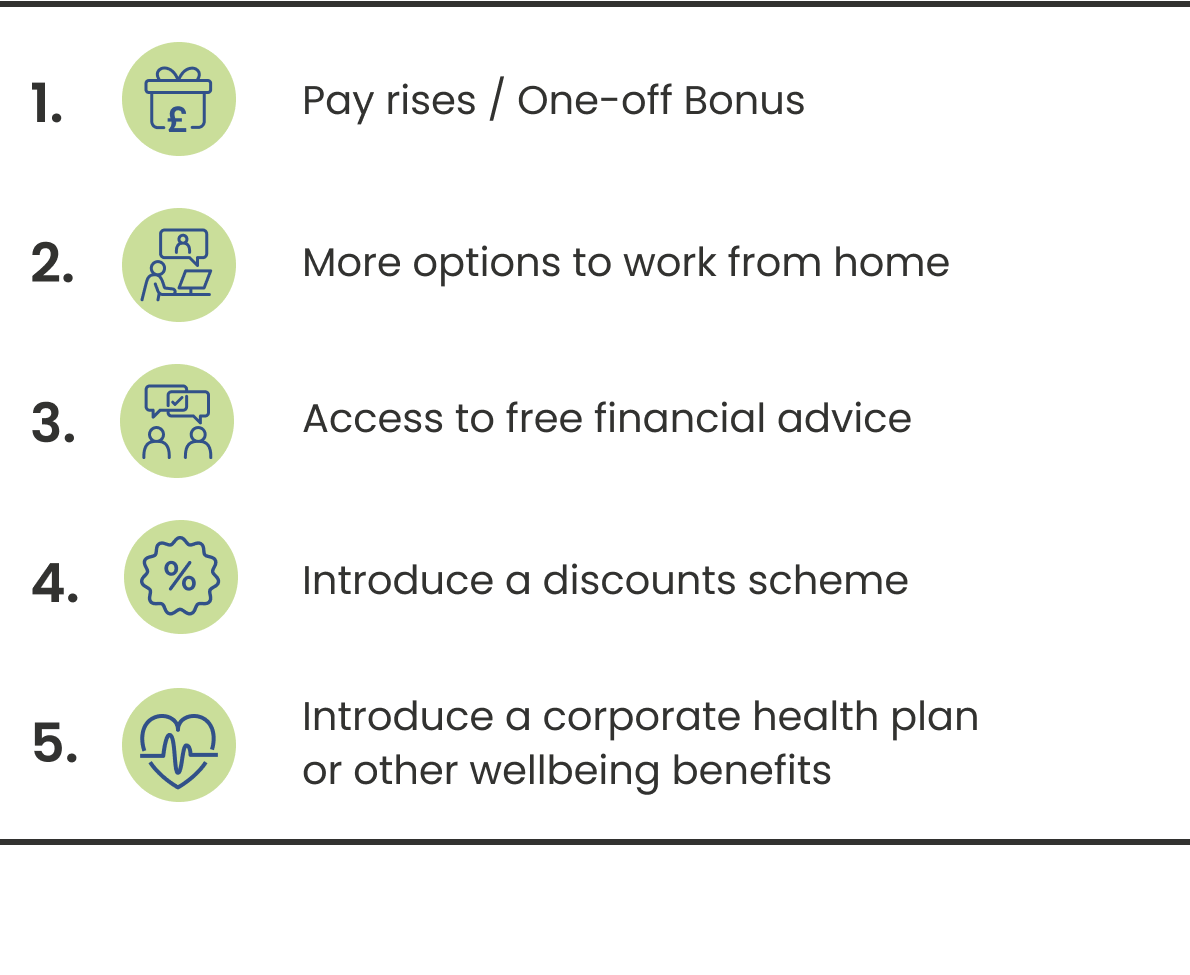

What is interesting to note, however, is the difference in priority when it comes to health plans and healthcare benefits. For employees, the introduction of a corporate health plan comes second only to a pay rise and opportunities for bonuses. Meanwhile, HR professionals place health plan implementation down in fifth place on their priorities, languishing behind the introduction of employee discounts.

HR professionals

Top 5 things you have done, or are planning to do, to reduce the impact of the cost of living crisis on employees.

Employees

Top 5 things your employer has introduced, or has announced they are going to do, to reduce the impact of the cost of living crisis.

Mental Health - still a challenging concept

Although much is being done by our HR professionals to help support the mental health and wellbeing of their workforce, there is still an educational divide that needs to be closed.

42% of our 2,000 UK-based employees thought that mental health support is only for those who are stressed in their job or worried about their workload. This shows a clear need for HR professionals to raise awareness among their employees that their mental health support benefits cover so much more than just work-related issues.

Many mental health support packages, such as employee assistance programmes, cover areas outside of the workplace, such as debt and relationship advice, eldercare and

bereavement, mental health training and support, meditation and relaxation apps, and more. These non-workplace issues can all have an impact on how well an individual performs in work.

With such a clear disconnect, it is apparent that HR professionals still have a lot of work to do to help their employees to understand what is being provided for them and how to access these services. As part of this, HR professionals need to reassure employees that these services are typically provided through third-party suppliers and that their discussions will be treated in the strictest confidence.

60% of employees feel that the Covid pandemic and the growing cost of living crisis have made employee benefits that help with financial or personal wellbeing more important than ever.

Wellbeing in the Workplace

Over recent years, wellbeing has moved from being a HR buzzword to a serious item on the boardroom agenda. This in part has been driven by the impact that Covid-19 had on many organisations in 2020, but there are an increasing number of studies and feedback from HR professionals to show that there really is a business case for companies to invest in the health and wellbeing of their workforce.

61% of the HR professionals surveyed believe that improved employee wellbeing leads to increased productivity within their organisation. And nearly half (44%) have managed to increase their organisation’s investment in employee health and wellbeing over the last three years.

But it’s not just HR professionals who are pushing this; the demand is coming from both existing and prospective employees. 39% of the HR professionals we surveyed said that they had seen an increase in demand from their existing workforce for new health and wellbeing benefits to be introduced, whilst 27% said that they’d seen an increase in potential new candidates asking them about the health benefits they had in place.

When asked, 81% of our HR professionals felt that their company supported both the physical and mental wellbeing of their workforce.

Yet, when we asked our employees the same question, only 58% felt that their workplace supported their wellbeing in some way, and more worryingly, 25% said that they got no support whatsoever.

Does your employer support your wellbeing in the workplace?

Behind the Benefits

Recruitment & Retention

Soft Factors

Despite the investment being made in health and wellbeing by many organisations, our survey also revealed that 60% of employees have looked for another job in the last 12 months, with 7% actually changing roles. This indicates a rift between the workplace benefits we think employees value, and the factors which actually lead to job satisfaction and employee retention.

So, what are the emotional factors which influence an employee’s choice of benefits?

71% of employees surveyed believe compassion counts, stating they would be more likely to stick it out in a job where they felt the employer genuinely cared about their wellbeing. That being said - it’s difficult to turn down some attractive benefits when you find them at a new company. In fact, 57% believed they could be tempted away from their current position by better health and wellbeing benefits elsewhere.

Factors on the global stage also have an impact on the perks employees would like to see in their workplace. 60% of employees believe the cost of living crisis, following closely in the wake of the Covid-19 pandemic, has made them consider the health benefits they receive at work, and the financial aid they provide, more closely.

Retaining Talent

HR professionals are seeing the correlation between employers who look out for the wellbeing of their staff, and a company’s ability to retain those employees.

One in four have had an employee leave for pastures new in the last three years as a result of the temptation of better health benefits elsewhere. Similarly two thirds have noted an uptick in both current and prospective employees asking about the health and wellbeing benefits offered by the company.

And while 81% of HR professionals believe that the company they work for provides an attractive health and wellbeing offering, 46% have noted difficulties when trying to attract and keep new talent over the last six months.

Conclusion

It is clear from the research that investing in the health and wellbeing of your workforce is a must for any organisation which wants to survive and thrive in the future.

Our range of corporate health cover, including health cash plans and employee assistance programmes, is helping an increasing number of organisations across the UK to look after the health and wellbeing of their workforce.

At a time when many individuals are facing mounting pressures on their finances, providing a health cash plan could not only help to support their physical and mental health, but also their financial wellbeing too.

Top benefits of having employer-provided health cover

Key benefits of a health cash plan

The difference between health cash plans and private medical insurance

While sounding similar, private medical insurance (PMI) and health cash plans are fundamentally different.

PMI is designed to cover the cost of private healthcare, from inpatient treatments to consulting specialist fees. Although premiums are typically high, PMI offers policyholders choices in how, where, and when they receive treatment.

Health cash plans, on the other hand, are significantly cheaper and can start from £5 per employee, per month. They provide cover for policyholders on everyday healthcare treatments and tests, such as optician’s appointments, dental fees, and physiotherapy, up to a set amount each year. They can often be used alongside NHS treatment, or to cover PMI excesses.

Final word

Employers need to realise that health cash plans are a way to invest in the financial wellbeing of their workforce, as there is a limit to how much companies can afford to give in pay rises in the current economic climate.

Employers should be doing everything they can to make net pay go further, as even the smallest impact can benefit employees, especially the lowest paid.